Home Owenership Pathways

Homeownership Pathways.

Understand how to qualify, apply, and own your home.

The Renewed Hope Homeownership framework provides multiple pathways designed to match the income levels, employment types, and financial realities of Nigerians. Whether you are a civil servant, artisan, trader, self-employed entrepreneur, or salaried worker, there is a clear and accessible route to owning your home under the Renewed Hope Agenda of President Bola Ahmed Tinubu, GCFR.

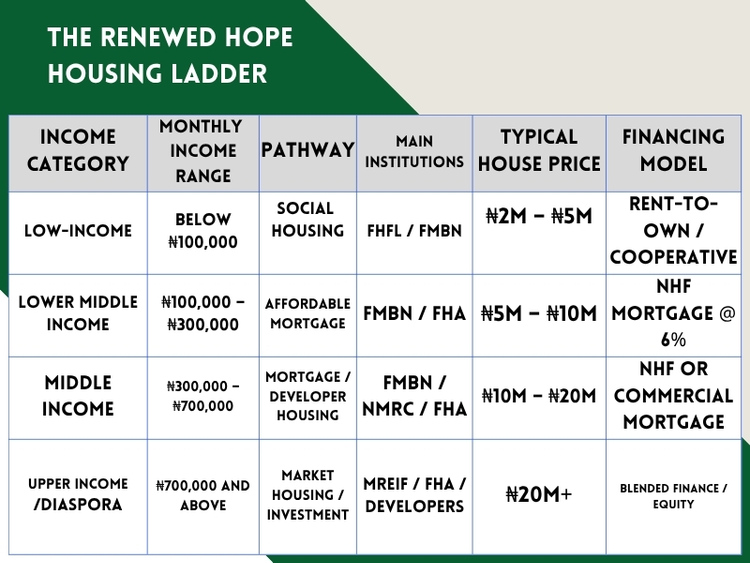

- The Renewed Hope Housing Ladder

At the core of the Renewed Hope Homeownership strategy is the Housing Ladder Model — a progressive system that allows Nigerians to enter at any level and move upward over time.

This section explains those pathways — from Social Housing for low-income earners, to Affordable Housing Mortgages for middle-income Nigerians, and Private Sector & Developer-Backed Schemes for higher-income groups. Each pathway connects you to one or more federal housing institutions, programmes, and financing products

Pathway 1: Social Housing (Low-Income Nigerians)

Lead Institution: Family Homes Funds Limited (FHFL)

Support Institutions: FMBN, State Governments, Cooperatives

This pathway is designed for Nigerians earning less than ₦100,000 per month — artisans, market traders, junior civil servants, and informal workers who often cannot access traditional mortgage finance.

Features:

- Houses priced between ₦2 million and ₦5 million.

- Flexible Rent-to-Own and Pay-As-You-Go options.

- Targeted at first-time homeowners.

- Often supported by state government land contributions and FHFL construction financing.

Example:

- A teacher earning ₦70,000 per month can access a 1-bedroom bungalow for ₦3 million at a Renewed Hope Social Housing Estate.

- After a modest upfront payment, they can move in and pay monthly rent that gradually converts to ownership over 15–20 years.

Access Steps:

- Identify a Renewed Hope Social Housing Estate in your state (check FMHUD/FHFL listings).

- Complete application form and provide BVN, ID, and income evidence.

- Receive allocation and move in once approved.

- Begin structured monthly repayments.

Pathway 2: Affordable Housing (Low-to-Middle Income Nigerians)

Lead Institution: Federal Mortgage Bank of Nigeria (FMBN)

Support Institutions: FHA, State Governments, Cooperative Societies

This pathway serves Nigerians earning between ₦100,000 and ₦300,000 monthly, typically civil servants, teachers, nurses, and small business owners.

Features:

- Access to NHF Mortgage Loan of up to ₦15 million.

- Interest rate: 6% per annum (subsidized).

- Repayment period: up to 30 years.

- Option for Cooperative Housing Development Loans for group members

- Rent-to-Own available for those unable to pay large deposits.

Example:

- A civil servant earning ₦200,000 monthly can qualify for a ₦10 million NHF mortgage to purchase a 2-bedroom apartment in an FHA or Renewed Hope Estate.

- Repayment may be as low as ₦60,000–₦70,000 per month over 20 years.

Access Steps:

- Contribute 2.5% of your monthly salary to the National Housing Fund (NHF) through FMBN.

- Apply through an accredited Primary Mortgage Bank (PMB).

- Submit proof of employment, payslips, and NHF number.

- Once approved, the FMBN disburses directly to the developer, and you take possession.

Pathway 3: Cooperative Housing (Self-Employed & Informal Sector)

Lead Institution: FMBN / FHFL

Support Institutions: State Housing Corporations, Cooperatives

For Nigerians without formal employment — traders, artisans, transport workers, and entrepreneurs — Cooperative Housing Schemes offer a collective route to homeownership.

Features:

- Members pool contributions through an organized cooperative society.

- The cooperative accesses bulk housing loans from FMBN or FHFL.

- FMBN funds construction; members repay monthly over agreed terms.

- Units are allocated based on each member’s savings and repayment ability.

Example:

- A market women’s association forms a cooperative of 100 members.

- They apply to FMBN for a ₦500 million Cooperative Housing Development Loan to build 100 units.

- Each woman moves into her unit and pays monthly over 15 years through the cooperative.

Access Steps:

- Register your cooperative with CAC and FMBN.

- Develop a housing proposal with a registered developer.

- Apply for the FMBN Cooperative Housing Development Loan.

- On completion, allocate units and begin repayment.

Pathway 4: Middle-Income and Diaspora Mortgage Pathway

Lead Institutions: NMRC / FMBN / FHA

Support Institutions: Participating Mortgage Banks, MREIF

For Nigerians earning ₦300,000 to ₦700,000 and above, including diaspora professionals and private-sector employees.

Features:

- Access to NHF Mortgages or commercial bank mortgages refinanced by NMRC.

- Loans for completed homes or construction on titled land.

- Long repayment tenors (up to 25 years).

- Competitive interest rates through NMRC-backed refinance instruments.

Example:

- A private sector employee earning ₦600,000 monthly buys a ₦15 million apartment at FHA Gwarinpa using an NMRC-refinanced mortgage.

- Repayment is spread over 20 years at ~9% interest.

Access Steps:

- Approach participating mortgage institutions (PMIs or banks).

- Present title documents, income verification, and NHF details (if applicable).

- Loan is refinanced by NMRC for long-term stability.

- Take possession upon disbursement.

Pathway 5: Developer/Investor and Public-Private Partnership (PPP) Pathway

Lead Institutions: FHA / FMHUD / MREIF (MOFI Real Estate Investment Fund)

Support Institutions: InfraCredit, DFIs, State Governments, Developers

This pathway empowers developers, institutional investors, and high-net-worth individuals to participate in large-scale housing delivery — while enabling end-buyers to access homes through off-take guarantees and rent-to-ownstructures.

Features:

- Developers receive off-take guarantees via MREIF for affordable units.

- FMHUD and FHA facilitate land and infrastructure.

- Buyers benefit from pre-arranged financing through FMBN, FHFL, or commercial lenders.

- Investors earn returns through equity participation or asset-backed securities.

Example:

- A developer constructs 1,000 units in Ogun State under the Renewed Hope Estate Programme.

- MREIF provides an off-take guarantee for 70% of the units.

- FMBN finances mortgages for buyers; InfraCredit enhances credit guarantees for developers.

Access Steps (for Developers):

- Submit Expression of Interest to FMHUD or FHA.

- Undergo project evaluation and due diligence.

- Secure off-take and financing structure through MREIF and partners.

- Begin construction with equity or debt injection.

Access Steps (for Buyers):

- Apply for a unit in an approved PPP Estate.

- Choose your financing path (mortgage, rent-to-own, or cash purchase).

- Complete documentation and move in.

Pathway 6: Rent-to-Own (Cross-Cutting Option)

Lead Institutions: FMBN / FHA / FHFL

Support Institutions: Cooperatives, Developers

The Rent-to-Own model is an inclusive solution that cuts across all income categories. It allows you to move into your home immediately and pay rent monthly or quarterly — with every payment counting toward ownership.

Features:

- Available for homes priced ₦2m – ₦15m.

- Tenure: 15–30 years.

- Fixed affordable rent, below market rate.

- Ownership transferred after full payment.

Example:

- A nurse earning ₦180,000 moves into a Renewed Hope 2-bedroom apartment in Nasarawa for ₦8 million.

- Pays ₦60,000 monthly for 20 years — and becomes a full homeowner at the end of the term.

Access Steps:

- Approach participating mortgage institutions (PMIs or banks).

- Present title documents, income verification, and NHF details (if applicable).

- Loan is refinanced by NMRC for long-term stability.

- Take possession upon disbursement.

Choosing the Right Path

To help Nigerians easily identify where they fit, the Renewed Hope Homeownership Guide provides a self-assessment checklist:

Ask Yourself:

- What is my monthly income?

- Am I employed, self-employed, or in the informal sector?

- Do I already contribute to the National Housing Fund (NHF)?

- Do I own land or plan to buy?

- Do I prefer to build, buy, or rent-to-own?